Share the post "Ofori-Atta Invents New Mafia Insurance To Force Travellers To Pay His Private Company"

-Toothless National Insurance Commission In Cahoots

The Akufo-Addo government has invented another opportunity for Finance Minister, Ken Ofori-Atta to milk money from the Kotoka International Airport (KIA) from International Travellers through a forced insurance policy called “Akwaaba Insurance”.

This dubious health insurance scheme which has sparked widespread anger among residents in Ghana and those in the diaspora and other foreigners is designed to force every international traveller to part with their hard-earned cash to buy another insurance cover upon arrival in Ghana, even if they already have a superior insurance cover from their countries of origin.

Critics point out the misnomer of the Ghanaian government attempting to force a health insurance policy on international travellers when Ghana has one of the poorest health systems in the world, with a poorly-managed emergency response infrastructure.

Meanwhile, out of the three companies to benefit from the controversial mandated insurance policy, Enterprise Insurance is a major spearhead. Incidentally, Enterprise is a company founded by Finance Minister, Ken Ofori-Atta.

This is the umpteenth time Ken Ofori-Atta’s private companies have been given free rein to capture key state resources.

Ghanaians business newspaper, B&FT was the one to first break the news, quoting Stephen Oduro, the Managing Director of the State Insurance Company (SIC), as saying: “Per provisions of the policy, every traveller coming into the country will be required to purchase the insurance regardless of the duration of stay and nationality.”

According to information gathered by Whatsup News, the dubious insurance scheme will be rolled out by March 2022, and the Interior Ministry has been given the marching order to “urgently” ratify the proposal to ensure it becomes operational “even before the end of the first quarter”.

In an attempted cover-up, the National Insurance Commission (NIC) on January 25, 2022, issued a statement claiming that the obnoxious insurance proposal was not mandatory, stating that “the Akwaaba Insurance has not been approved by the Commission”.

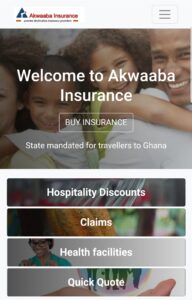

Yet, all the documents on the insurance seen by Whatsup News show that it is intended to be made mandatory. In fact, the website of the insurance policy; www.akwaabainsurance.

The home page of the website reads: “Welcome to Akwaaba Insurance, State-mandated for travellers to Ghana.”

This is an additional burden on international travellers who had already been forced to cough up as much as US$ 100 to undertake COVID-19 antigen tests on arrival at KIA. The test is being conducted by Frontier Health Services, a company linked to family and friends of President Akufo Addo.

The exact cost of buying the policy is unknown, but on the website of Akwaaba, it lists what it calls “benefits” with rates as high as GHC 50,000 for medical expenses or medical evacuation for the four policies listed on its website: Akwaaba Leisure, Akwaaba Gold, Akwaaba Student and Multiple Travel.

The Mafia-like insurance is to be provided by a so-called ‘consortium of three insurance companies’ including State Insurance Company PLC (SIC), GLICO Insurance Company and the rather ubiquitous Enterprise Insurance owned by Finance Minister Ken Ofori-Atta.

Obviously, this will ensure that the three companies get a steady flow of clients from whom they can milk money.

Of the three companies, only SIC can be said not to be under the ownership of friends of the government – While Enterprise is owned by the Finance Minister, GLICO Life, which is part of the GLICO Group, is owned by a financier of the NPP, Mr. K. Achampong-Kyei.

The compulsory Akwaaba Insurance policy, therefore, appears to be an invention to help Ofori-Atta and government amigo, K. Acheampong-Kyei milk people for money as had been done by Frontier for arm-twisting travellers for US$ 100 to undertake COVID-19 antigen tests that are free in many countries or cost less than US$ 30 per session.

Critics think the state-owned SIC was only thrown into the mix to provide cover for the whole sweetheart deal.

This is not the first time that the government has invented an opportunistic deal for Ofori-Atta’s private companies, including Enterprise Life and Acheampong-Kyei’s GLICO Life.

In 2017, similar compulsory insurance was invented for National Service personnel in which Enterprise and GLICO Life were listed as the companies to provide the compulsory insurance.

However, the NSS personnel protested, and eventually, the government had to scrape that insurance product.

Close in the heels of the travel insurance is the plans of the Akufo Addo administration to scheme another compulsory insurance for all students of tertiary institutions, with Ken Ofori-Atta’s Enterprise Insurance being a beneficiary.

The same Enterprise Insurance had been hired by the government to underwrite its bonds, including the scandalous Franklin Templeton US$2.25billion bond in 2017.

While at it, Ofori-Atta’s private investment brokerage firm, Databank Financial Services is one of two private companies hired as consultants for the Akufo Addo government’s bond transactions which has so far grossed billions of dollars