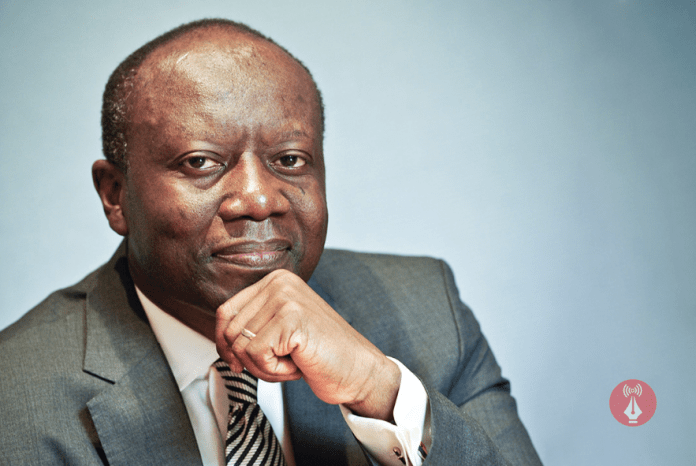

Whatsup News has intercepted documents forming parts of a series of letters sent to private dealers who serve as transaction advisers to Ghana’s Eurobonds and other money market transactions, asking them to step aside, in what will solidify the private companies of Finance Minister Ken Ofori-Atta and his former Deputy, Charles Adu Boahen as the major transaction advisors.

Essentially, some private dealing companies in Ghana were arm-twisted to terminate their contract with the government of Ghana to pave the way for Blackstar Brokerage Limited owned by Charles Adu Boahen and Databank Financial Services owned by Ken Ofori-Atta to take a substantial part of commissions accruing anytime Ghana is saddled with money market debt transactions such as the infamous Eurobond.

The companies of these two officials would be collecting some GHC 210 million in total transaction fees and commissions, Whatsup News has gathered.

The letters sent to these companies forcing them to resign were sent sometime in March 2021 by James Clark, an executive of the UK-based law firm, White and Case LLP.

In the transaction agreement signed between the government of Ghana and these private brokers in 2019, they can only terminate their involvement as transaction advisors for the government only after a 30-day notice of termination of the relationship by the private brokers (dealers).

However, White & Case, which is apparently being coached by Ken Ofori-Atta wrote to the companies to waive the 30-day grace period.

It must be noted that White & Case is the same law firm used by Finance Minister Ken Ofori-Atta in the fraudulent Agyapa Royalties deal that was torpedoed after a damning corruption assessment by former Special Prosecutor, Martin Amidu revealed that Ken Ofori-Atta had used a South African company, Imara Corporate Finance to front for Databank Financial Services to appoint White & Case LLP as the legal advisor to the dubious Agyapa deal.

It is the same White & Case being use once more in a questionable move that is ensuring that the private companies of the Finance Minister and that of his former Deputy are the major players to benefit in transaction fees anytime Ghana secures more debts from the international money market.

On May 5, 2021, Whatsup News wrote an email to White & Case’s James Clark to find out the reasons why they are kicking out other dealers and retaining companies owned by the Finance Minister and his deputy.

However, James Clark refused to respond to our inquiry.

In the letter sent to some of the dealers, James Clark wrote a template for them to tender as their own and as their intent to terminate their deal to act as dealers for the government of Ghana.

The template letter reads in part: “Pursuant to Clause 11 of the Programme Agreement relating to the Programme of the Republic of Ghana dated 18 March 2019 (the “Programme Agreement”), we hereby give you notice of termination as Dealer under the Programme Agreement and that your appointments as such are hereby terminated.”

It reads further: “We acknowledge that, pursuant to Clause 11 of the Dealer Agreement, you are entitled to not less than 30 days written notice before such termination shall be effective and, accordingly, we respectfully request that you waive this requirement of such notice period so that the termination of your appointment as Dealer under the Programme Agreement shall be effective immediately as of the date of this letter.”

In sync with the intricate scheming by Ofori-Atta and Charles Boahen, the Akufo-Addo government recently published a list of transaction advisors for a slew of loans that it is borrowing from the international money market, and unsurprisingly, Databank and Blackstar Brokerage Limited were featured prominently in it.

Isaac Adongo wrote, the Member of Parliament for Bolga Central, has taken the insider trading up and has called out the Finance Minister and his ally Charles Boahen out for their conflict of interest.

“The duo, Ken Ofori Atta and Charles Adu Boahen have thus literally awarded to themselves through their companies the lucrative contracts that involve managing Government’s borrowing program with an estimated Ghc60 billion a year gross financing. The fees to be shared by the transaction advisors of the government borrowing program, including Ken Ofori Atta and Charles Adu Boahen’s companies, is estimated at Ghc210 million a year,”

Adongo reiterates his concerns that the conflict of interest allows Ken Ofori-Atta to instigate State borrowing just so that his company, can keep on creaming off commissions from transaction services provided for such borrowings.

“If you ever wondered why Ghana’s public debt has since 2017 been growing at an unexplained geometric sequence, the reasons are here: Those in charge of the borrowing, stand to personally profit from the borrowing through the reward in fees to their companies who serve as their transportation advisors,” Adongo wrote in a scathing statement he released last week.