Share the post "Bank of England ‘ready to act’ as economy shrinks record 20%"

Bank of England governor Andrew Bailey has said he will be “ready to take action” to help the UK economy weather the coronavirus crisis.

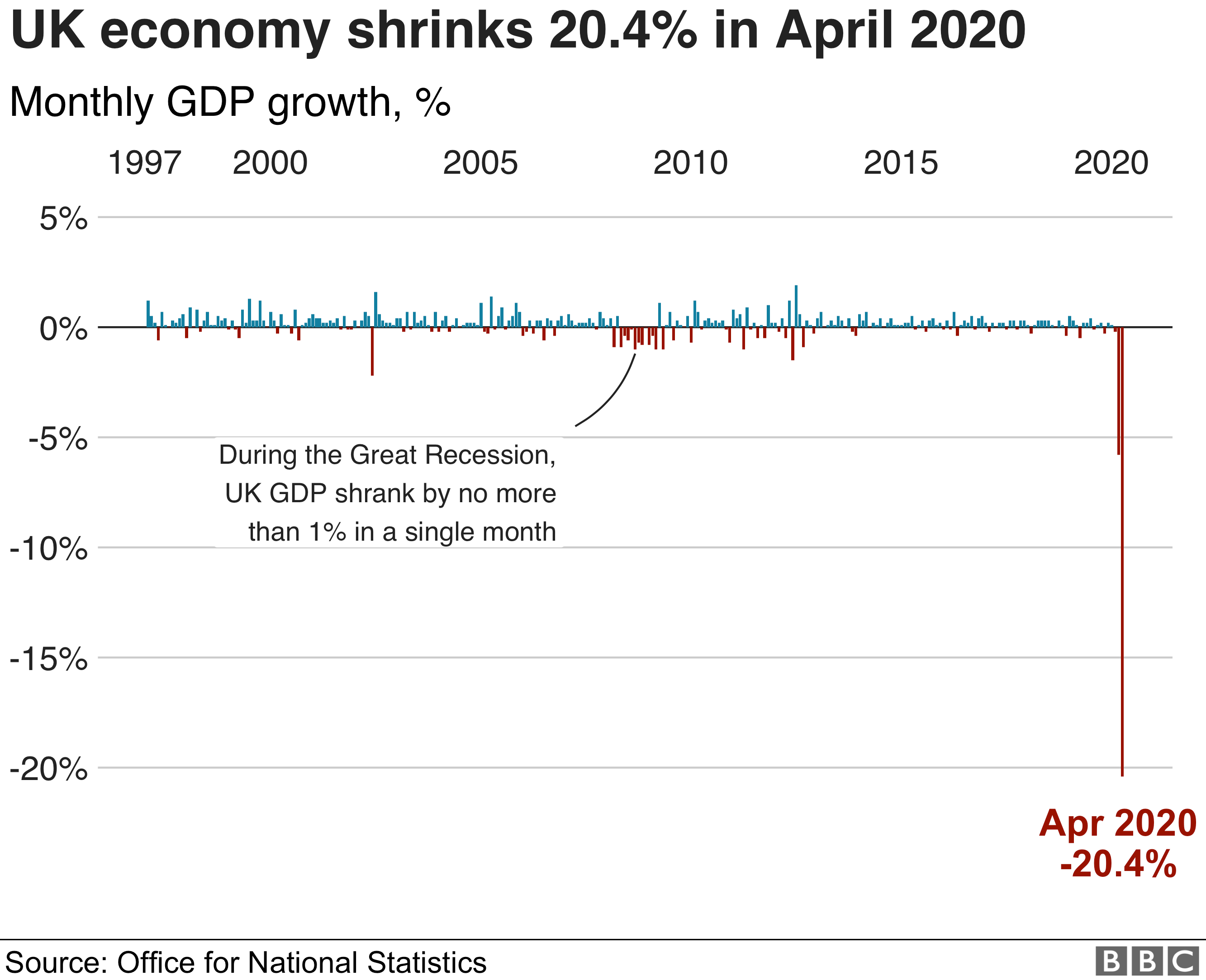

He was speaking after figures showed that the country’s economy shrank by 20.4% in April – the largest monthly contraction on record – as the country spent its first full month in lockdown.

“We are still very much in the midst of this,” Mr Bailey said.

But he said the figure was “pretty much in line” with what the bank expected.

“Obviously it’s a dramatic and big number, but actually it’s not a surprising number,” he said.

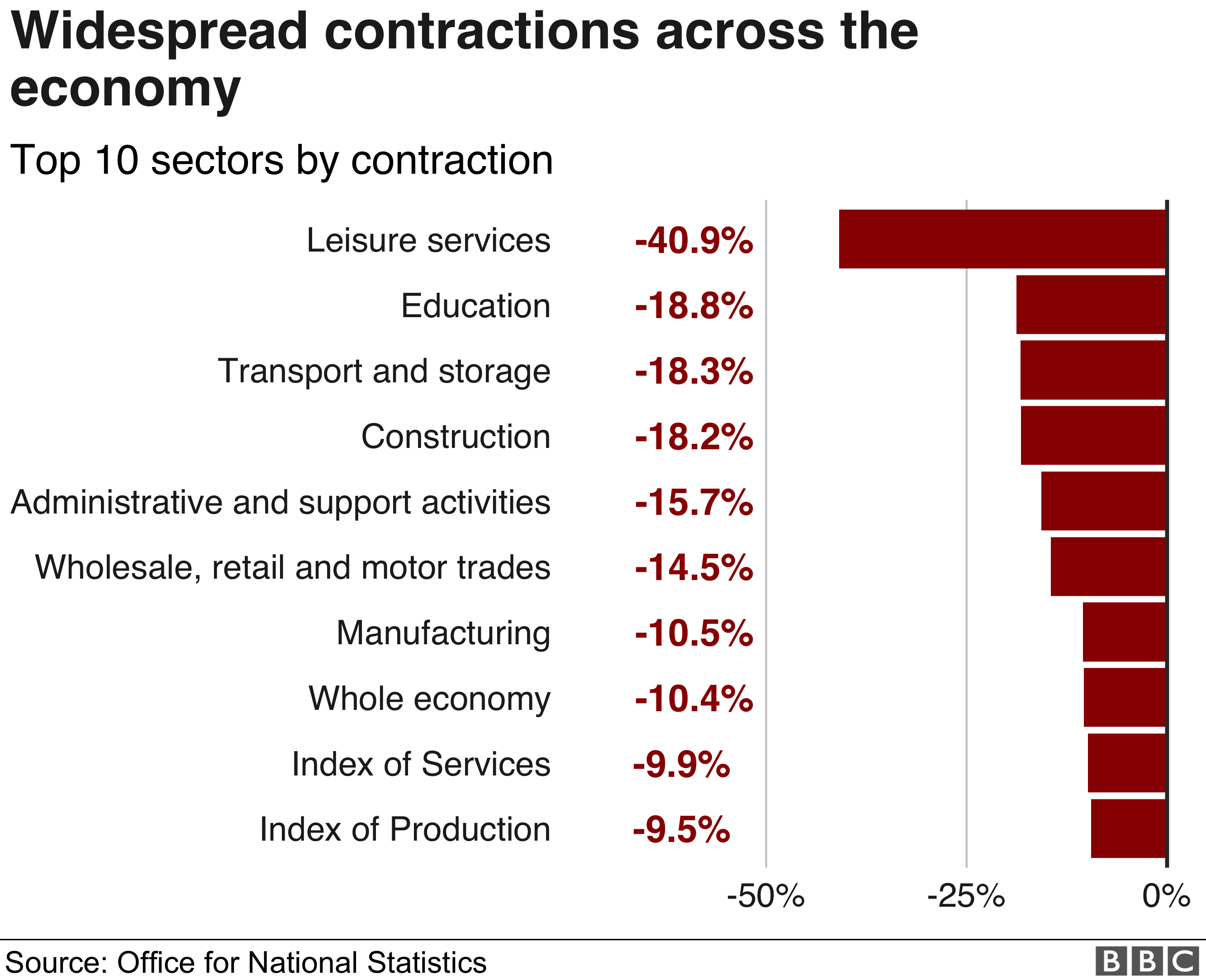

The Office for National Statistics (ONS) said April’s “historic” fall affected virtually all areas of activity, as large parts of the economy remained shut to battle the pandemic.

The contraction is three times greater than the decline seen during the whole of the 2008 to 2009 economic downturn.

But analysts said April was likely to be the worst month, as the government began easing the lockdown in May.

What else did the governor say?

Mr Bailey said there were “signs of the economy now beginning to come back into life”, but the big question was how much long-term damage the pandemic would cause.

“That’s the thing we’ve got to be very focused on, because that’s where jobs get lost,” he said.

“Now we hope that will be as small as possible, but we have to be ready and ready to take action, not just the Bank of England, but more broadly on what we can do to offset those longer-term and damaging effects.”

The ONS also published figures for the three months from February to April, which showed a decline of 10.4% compared with the previous three-month period.

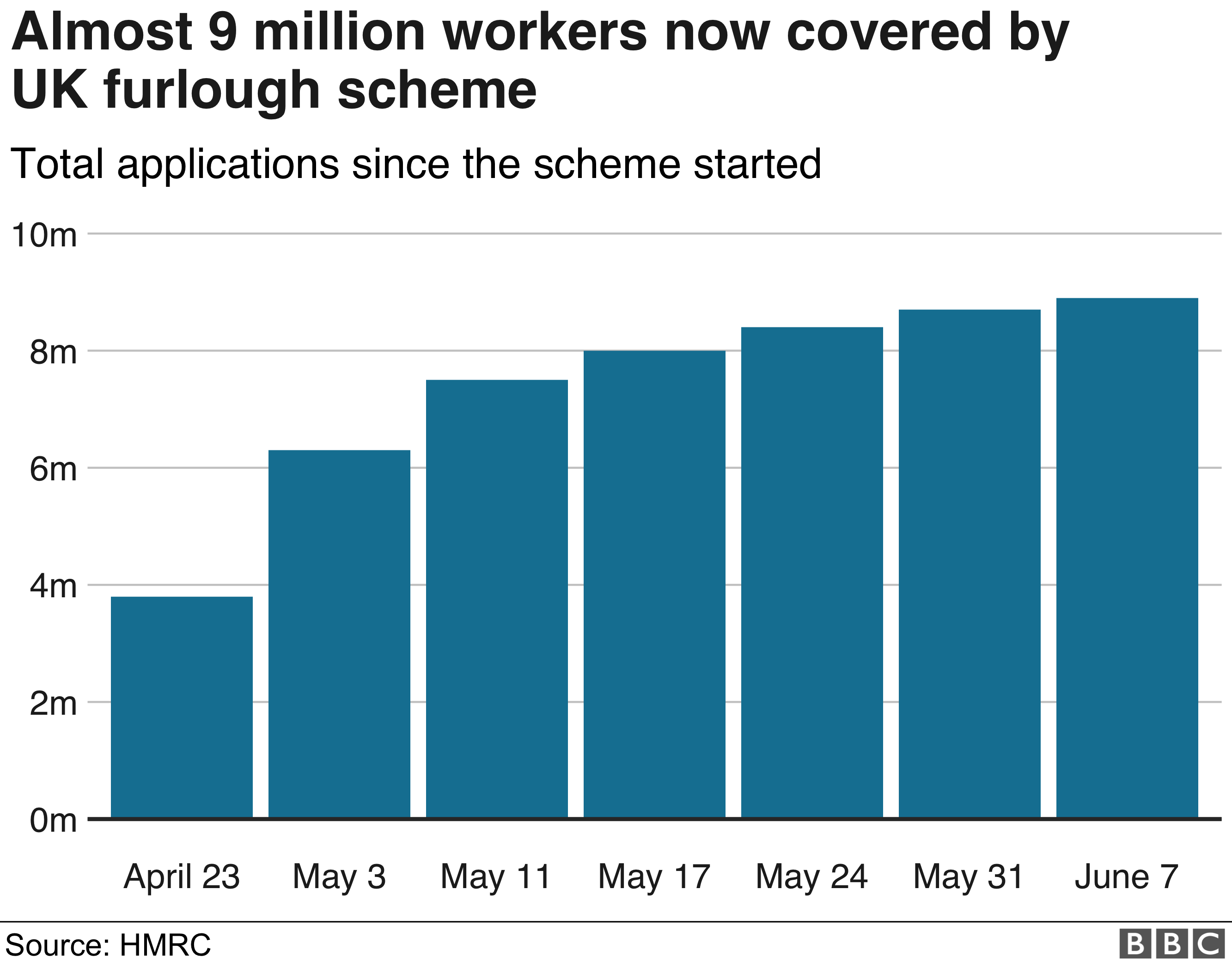

News of the slump comes as almost nine million UK workers are having their wages paid by the government, while the number of people claiming unemployment benefit rocketed by 856,500 to 2.1 million in April.

What was the political reaction?

Prime Minister Boris Johnson warned of a “tough” few months ahead, but added: “We will get through it.”

“We’ve always been in no doubt this was going to be a very serious public health crisis but also have big, big economic knock-on effects.

“The UK is heavily dependent on services, we’re a dynamic creative economy, we depend so much on human contact. We have been very badly hit by this.”

Chancellor Rishi Sunak said life would get “a little bit more back to normal” once High Street shops could reopen.

That is set to happen on Monday in England, while shops in Northern Ireland have already been allowed to resume trading. Scotland and Wales have their own timetables for easing restrictions.

In response, shadow chancellor Anneliese Dodds warned that the UK’s economy was shrinking faster than those of other countries.

She said the UK would need “strong action to help us climb out of this as quickly as possible”.

What has happened to the economy?

In normal times, a country’s Gross Domestic Product (GDP) – the value of the goods and services it produces – increases, making its citizens on average slightly richer. However, the ONS said April’s fall in GDP was the biggest the UK had ever seen.

“[The fall was] more than three times larger than last month and almost 10 times larger than the steepest pre-Covid-19 fall,” said Jonathan Athow, the agency’s deputy national statistician for economic statistics.

“In April, the economy was around 25% smaller than in February.”

He said virtually all areas of the economy had been hit, with pubs, education, health and car sales all seeing marked falls in activity.

Carmakers and housebuilders were also badly affected, although Mr Athow told the BBC’s Today programme: “It’s highly likely April will be the low point.

“Our own surveys and wider indicators have suggested a pick-up in economy activity, but I think it’s really too early to know how quickly economic activity will recover in the coming months.”

So the economy has shrunk 20%. How come the other 80% is still standing?

In large part, thanks to the extraordinary levels of state intervention propping it up.

More than one in four UK workers – some 8.9 million – are now on the government’s furlough scheme that allows them to receive 80% of their monthly salary up to £2,500.

The scheme has cost £19.6bn so far, while a similar programme for self-employed workers has seen 2.6 million claims made worth £7.5bn.

Without these schemes, household consumption, which makes up nearly two-thirds of the UK’s GDP, would have fallen even further.

Staying positive

Sophie Lawler’s 17 health clubs remain closed to their 100,000 members in the north of England and Wales. And like the rest of the fitness sector, she has no idea when she might get the green light to reopen.

“The whole sector has struggled financially, and may do so for years to come,” she said. “The industry is shouldering quite some rental burden, costs we still incur even while we’re closed.”

Furloughing has been vital, she says, but she’d like the government to do more – perhaps in the form of VAT exemptions or more support for leaseholders.

Despite the uncertainties, however, she thinks the sector will weather the storm. “In terms of demand, we will do pretty well when we get through to the other side of this.”

The ONS numbers add to the pressure to ease the lockdown more quickly, but fears around the control of the disease have led to a step-by-step cautious approach.

There is some pressure on the Treasury to consider similar economic rescue packages to those made across Europe.

Germany, for example, has cut VAT and offered billions in a package to help families with children and purchasers of green cars. France is offering huge rescue funds to the car and aerospace industry.

The unprecedented jobs schemes here will help to protect livelihoods. But with this scale of hit, it will not be enough.

How does this slump compare historically?

During the global financial crisis, from the peak in February 2008 to the lowest point of March 2009, a total of 13 months, GDP shrank by 6.9%.

April’s unprecedented contraction is three times that – and it happened in one month.

The UK’s economy was already shrinking even before April.

It contracted by 2% in the first three months of 2020, as just a few days of impact from the virus pushed it into decline.

Economists expect an even bigger slump in the April-to-June period, plunging the country into a deep recession.

So where do we go from here?

“Given the lockdown started to be eased in May, April will mark the trough in GDP. So we are past the worst,” said Andrew Wishart, UK economist at Capital Economics.

“But the recovery will be a drawn-out affair, as restrictions are only lifted gradually and businesses and consumers continue to exercise caution.”

Tej Parikh, chief economist at the Institute of Directors, said coronavirus had caused “unparalleled” economic turmoil which was “likely to scar the UK economy for some time yet”.

“Having provided businesses life support, the government must now figure out how to stimulate activity,” he added.

“Waiting until later in the year to act will risk more businesses and jobs will be lost.”

How does the UK economy compare with other countries?

We don’t really know yet. The UK is one of the few countries to publish monthly economic data – most others just produce quarterly and annual figures.

We do know, however, that coronavirus has already pushed several major economies into recession:

- Japan saw a 3.4% fall in GDP for the first three months of 2020

- Germany’s economy shrank by 2.2% in the first three months of this year

- And France saw a 5.8% contraction in the first quarter of 2020.

On Wednesday, the Organisation for Economic Co-operation and Development warned that the UK could be the hardest hit by Covid-19 among major economies.

The British economy is likely to shrink by 11.5% in 2020, slightly outstripping falls in countries such as Germany, France, Spain and Italy, it said.

What is a recession?

A recession is usually defined as two three-month periods – or quarters – of economic contraction in a row.

Technically, we are not at that point yet. But the UK, along with much of the rest of the world, is thought to be heading into the worst recession for decades.

bbc