Share the post "Power producers to charge Getfund levy, NHIL and VAT on supplies to ECG"

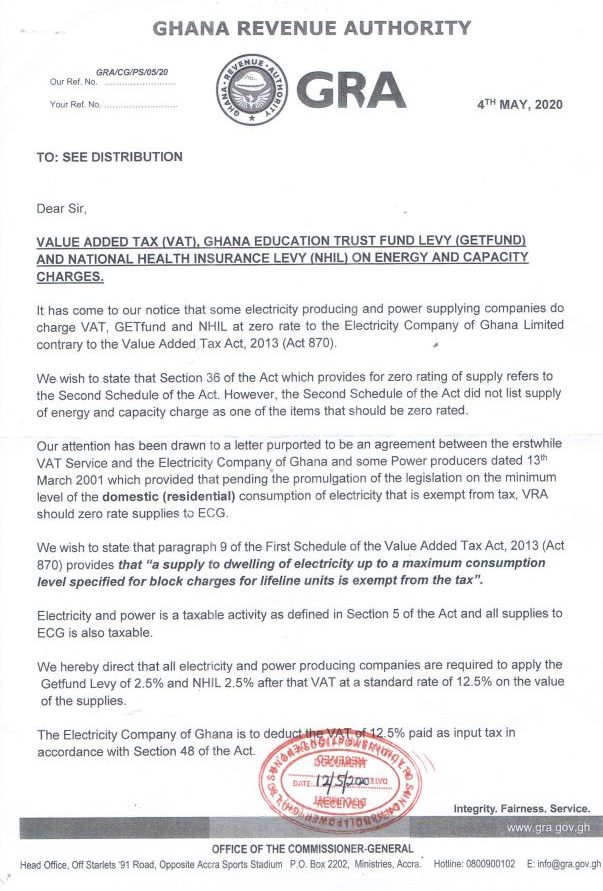

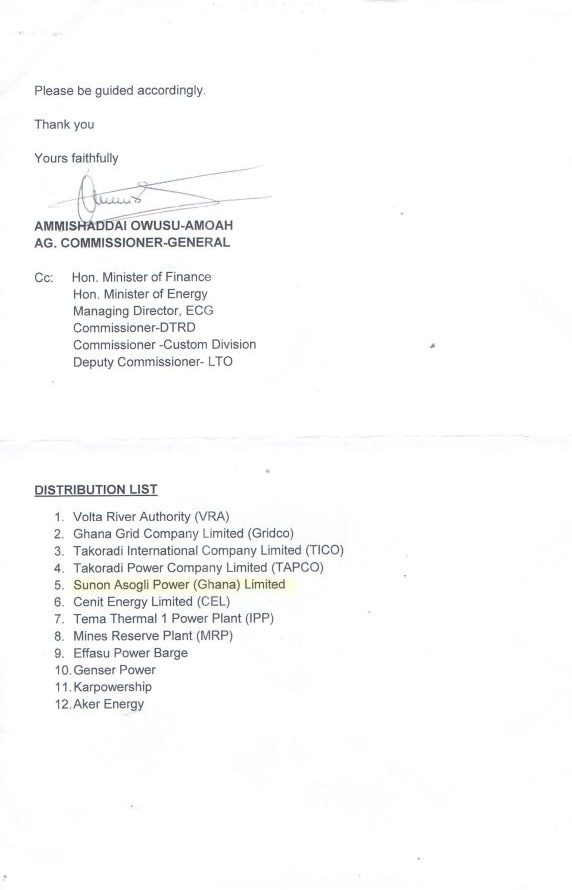

The Ghana Revenue Authority (GRA) has directed all electricity and power-producing companies in the country to apply the Getfund Levy of 2.5%, National Health Insurance Levy (NHIL) of 2.5% and Value Added Tax (VAT) at a standard rate of 12.5% on the value of power supplies to the Electricity Company of Ghana (ECG).

According to the Authority, their attention was drawn to a letter purported to be an agreement between the erstwhile VAT Service and ECG and some power producers which stated that the VRA should zero rate supplies to ECG.

This, the GRA, said is in contravention to the Value Added Tax, 2013 (Act 870) which does not list supply of energy and capacity charge as one of the items that should be zero-rated.

“We wish to state that Section 36 of the Act which provides for zero-rating of supply refers to the Second Schedule of the Act. However, the Second Schedule of the Act did not list supply of energy and capacity charge as one of the items that should be zero-rated,” GRA said.

In a statement signed by its Acting Commissioner-General, Ammishadai Owusu-Amoah, the GRA made clear that “electricity and power is a taxable activity as defined in section 5 of the Act and all supplies to ECG is also taxable.”

They are, therefore, directing all electricity and power producers to start charging ECG the prescribed levies under the law.

Source: Cornerlis Kweku Affre