The Central Bank of Ghana has indicated its intent to connect about 23 leading banks in the country to its newly established Financial Industry Security Operating Center next year.

The streamline is aimed at curbing the spate of cyber fraud in the system.

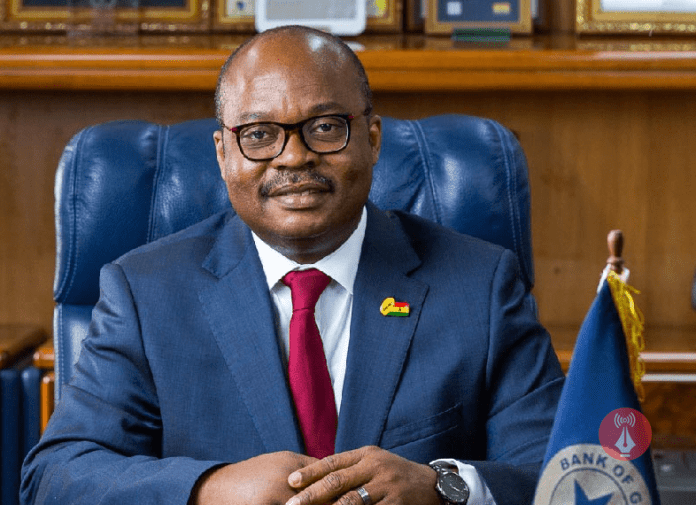

Interacting with Business and Financial Journalists in Accra, the Governor of the Bank of Ghana, Dr. Ernest Addison noted that the central bank’s decision to roll the banks onto the FISOC platform was a result of the recent rise in the number and value of ATM fraud cases and other types of fraud, as captured in the 2020 banking industry fraud report.

“This is a developing matter, we are investigating it. As you know, the financial services are becoming technology-driven financial services, the risk associated with ATMs will also go up. Fortunately, we are looking very closely at that”, he said.

According to him with the connection of all banks to the industry hub, the Bank of Ghana will be in the best position to be able to monitor the cyber risk associated with the country’s financial system.

Findings from the Bank of Ghana’s 2020 Banking Industry Fraud Report confirmed that ATM/POS fraud recorded the highest reported loss value of approximately GH¢ 8.20 million in 2020, as compared to an approximate loss value of GH¢ 1.26 million recorded in 2019.

This represents a 548.0 % increase in losses in year-on-year terms. The record notes that most of these losses are card-related fraud.

The report called on financial institutions and E-Money Issuers to put in place transaction monitoring systems that can identify unusual spending patterns and potentially fraudulent transactions.

It also recommended that the banking industry should put in place, measures designed to raise awareness of cyber/e-mail-related crime among consumers, noting that information sharing between banks on counter-measures against fraudulent activities should be encouraged to help protect the industry and its customers from fraud.